At CM Lawyers, we understand that navigating ASIC Aus requirements can be difficult, especially with some recent changes. ASIC has just released new liquidator guidelines as part of their insolvency reforms, so affected businesses, especially those facing financial difficulties, may need to adjust their operations.

The revised guidelines appear in ASIC Aus’ Regulatory Guide (RG 258). With new rules in place, liquidators Australia-wide should adhere to the set standards of transparency and professionalism that come with ASIC registration.

A New Approach to Liquidator Guidelines

Drawing on input from industry stakeholders, ASIC Aus has been working for some years to address insolvency in Australia, which includes the new ASIC business guidelines. In order to help businesses with their operations, ASIC has released a report that focuses on improving efficiency in the ASIC business registration procedures and proposing new guidelines for certified professionals managing insolvent companies in accordance with ASIC insolvency procedures.

It is vital to comprehend the functions of liquidators Australia-wide in light of the recent ASIC report, regardless of whether you are a creditor seeking protection or your organization is encountering financial difficulties. ASIC's insolvency procedures have been better defined, which has made it simpler for businesses to determine what to do in such a situation.

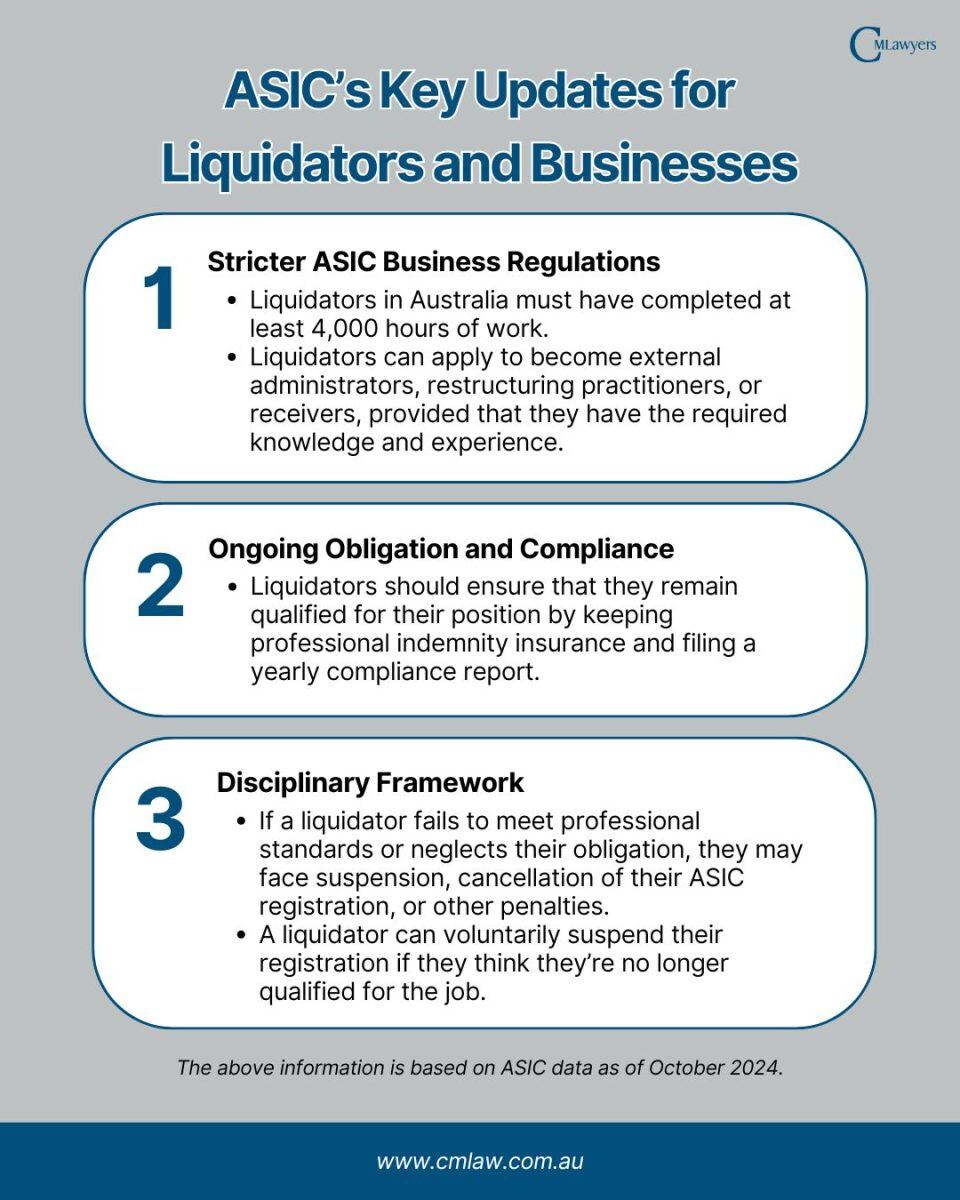

Key Updates for Liquidators and Businesses

Reading the updated ASIC report, also known as the Revised Regulatory Guide (RG 258), may be daunting, as it comes with over a hundred pages, but don’t worry, we’ve checked its contents for you. Additionally, we used ASIC’s Consultation Paper 376 (CP 376) and Report 796 (REP 796) as a cross-references. CP 376 precedes the updated RG 258, serving as the basis of the reforms, while REP 796 was released as a response to submissions on CP 376.

Whether you’re concerned with ASIC business registration or ASIC insolvency procedures, understanding the changes from ASIC Aus can help with your business. Based on these reports, we came up with three key updates that liquidators and businesses should know. You may check out the infographic below for quick information or scroll further down for more details.

Stricter ASIC Business Regulations

Businesses can expect stricter regulations, especially for liquidators, imposed by ASIC Aus. The updated ASIC business process for liquidators Australia-wide offers more clarity and distinct pathways. For instance, liquidators can apply to become external administrators, restructuring practitioners, or receivers, depending on their qualifications and experience. ASIC Aus also requires liquidators to have completed at least 4,000 hours of work. These standards aim to ensure that liquidators can manage insolvency cases with ease. (CP 376)

Ongoing Obligations and Compliance

Liquidators are required to adhere to ASIC business guidelines upon ASIC registration. This includes keeping professional indemnity insurance and filing a yearly report confirming their compliance to ASIC business standards. (CP 376) (REP 796)

ASIC also highlights the importance of liquidators remaining qualified for their position. There will be a continuous monitoring for liquidators Australia-wide to ensure that they meet their obligations, safeguard stakeholders, and maintain the integrity of the ASIC insolvency procedures. (CP 376) (REP 796)

Disciplinary Framework

A more definitive disciplinary structure is also included in the new guidelines. Liquidators who don’t meet the requirements in the ASIC report or neglect their obligations may face suspension, cancellation of their ASIC registration, or other penalties. If liquidators think that they no longer meet the standards for their position, they’re encouraged under ASIC insolvency rules to voluntarily suspend their registration. (CP 376) (REP 796)

The latest ASIC report emphasizes transparency, as ASIC now has the authority to make public the details of disciplinary actions. Businesses should be knowledgeable about these updates, as engaging with registered liquidators Australia-wide ensures that their affairs are managed by professionals who adhere to ASIC business guidelines.

The Impact on Businesses

The updates found on the recent ASIC report is especially critical to businesses facing or at risk of insolvency, especially amidst economic downturns. It is essential to understand ASIC business registration, ASIC insolvency reforms, and liquidator compliance since they directly influence businesses facing financial challenges. (CP 376)

Additionally, small firms now have more options with ASIC Aus' introduction of restructuring practitioners, a new category of liquidators. With restructuring practitioners, businesses can consider other choices before resorting to closure.

Why Consult a Legal Professional

At CM Lawyers, we understand that it can be difficult to navigate ASIC insolvency proceedings and comprehend ASIC registration requirements. Every case has a different set of difficulties, even though the most recent ASIC report attempts to protect companies, creditors, and other stakeholders. Hence, speaking with legal experts knowledgeable about ASIC business standards is crucial because they can assist you even with unforeseen circumstances.

CM Lawyers can give you sound legal advice, whether you’re a creditor, a company looking to get an ASIC business registration, or a company considering insolvency or restructuring options. Our goal is to help you meet ASIC requirements while safeguarding your interests at every turn.

Moving Forward with Confidence

For liquidators all around Australia, the release of ASIC's new guidelines represents a significant advancement. ASIC Aus' new rules will help uphold and enhance insolvency standards with more stringent ASIC business registration requirements, increased compliance obligations, and stronger disciplinary requirements.

We can help you if you need advice on ASIC registration, ASIC insolvency procedures, or the general requirements of ASIC Aus. For legal assistance tailored to your company’s needs, please don’t hesitate to get in touch with us. Together, we can come up with solutions that both adhere to ASIC compliance and protect your company’s interest.

Sources

Comments