Purchasing property “off the plan” in New South Wales (NSW) can be a smart way to secure a brand-new home or investment property before it's even built. For those searching online for homes to buy near me, real estate listings near me, or property for sale in growing suburbs, off-the-plan opportunities are often appealing due to modern designs, flexible payment timelines, and potential capital gains.

However, buying off the plan also comes with unique legal terms and potential risks. One key feature in these contracts is the sunset clause, which sets a deadline for project completion but can, in some cases, be used by developers to cancel the contract. Thankfully, recent reforms in NSW law have strengthened protections for buyers, making it harder for developers to rescind contracts unfairly.

At CM Lawyers, we understand how daunting it can be to navigate legal documents while searching for realty near me or comparing property for sale options. Our experienced property lawyers can help you review your off-the-plan contract in detail, explain the sunset clause implications, and ensure your rights are protected.

In this blog, we’ll break down what a sunset clause is, how the new legal protections work, and offer practical tips to help you make an informed decision. Whether you're a first-home buyer or an investor exploring real estate listings near me, this guide will help you approach off-the-plan purchases with confidence.

What Is a Sunset Clause?

A sunset clause is a key provision in off-the-plan property contracts. It sets a specific deadline—known as the sunset date—by which the developer must complete construction and register the title to the property. If this deadline passes without completion, the contract can be rescinded (terminated). In most cases, this means the buyer receives a full refund of their deposit.

Sunset clauses are especially important to understand if you're exploring homes to buy near me or browsing real estate listings near me with the intention of purchasing off the plan. While these contracts offer early access to newly built properties, the sunset clause governs what happens if delays occur.

Why Do Sunset Clauses Exist?

Sunset clauses serve a practical purpose in off-the-plan property contracts—they create a fair exit strategy for both parties if a development doesn’t go as planned. Whether you’re a buyer browsing realty near me or a developer facing unforeseen challenges, the clause provides legal clarity around contract termination and deposit refunds.

For Buyers:

Sunset clauses offer a layer of protection by ensuring you're not locked into a contract indefinitely. If a development project is significantly delayed, buyers shouldn’t be left in limbo. This is particularly relevant for first-home buyers or investors who are actively searching for property for sale or realty near me, and who may need to pivot quickly if a development doesn't proceed as planned.

For Developers:

Developers also benefit from sunset clauses. If unexpected issues arise—such as planning approval complications, financing troubles, or major construction delays—a sunset clause allows them to legally exit the contract. This flexibility is essential in complex development projects that may face shifting timelines.

How Have Sunset Clauses Been Misused?

Although sunset clauses are designed to provide fairness and flexibility in off-the-plan contracts, they have unfortunately been misused by some developers, particularly during periods of strong property market growth. In high-demand areas—where buyers are actively searching for homes to buy near me or scanning real estate listings near me—certain developers have exploited these clauses to their advantage.

A common tactic has involved developers deliberately delaying construction until after the sunset date, then using the expired clause to rescind the contract. While the buyer would typically receive a refund of their deposit, they were left in a difficult position: the same property was often resold at a significantly higher price, leaving the original buyer priced out of the market.

For example, someone who had secured an off-the-plan apartment two years earlier while exploring property for sale might find that, after the contract was terminated, similar properties in the same suburb were now well beyond their budget. This practice caused significant stress and financial loss, especially for first-home buyers and families relying on stable prices when purchasing through local realty near me options.

NSW Law: Stronger Protections for Buyers

To stop these unfair practices, the NSW Government introduced stronger legal protections for buyers through reforms to the Conveyancing Act 1919, specifically sections 66ZL and 66ZS. These reforms apply to all off-the-plan residential property contracts in NSW, including those signed before the changes came into effect in November 2015.

Under the new rules, developers can no longer unilaterally rescind a contract once the sunset date passes. Instead, they must either:

-

Obtain written consent from all affected purchasers, or

-

Apply to the NSW Supreme Court and prove that rescission is just and equitable in the circumstances.

These legal reforms aim to protect everyday buyers—those looking for realty near me or homes to buy near me—from losing out due to opportunistic contract terminations. By ensuring developers are held accountable, the legislation gives buyers more confidence when entering off-the-plan agreements.

At CM Lawyers, we can help you understand your rights under these laws and review your off-the-plan contract before you commit. Whether you’re looking at new builds or comparing property for sale in your area, our experienced legal team will ensure you’re protected every step of the way.

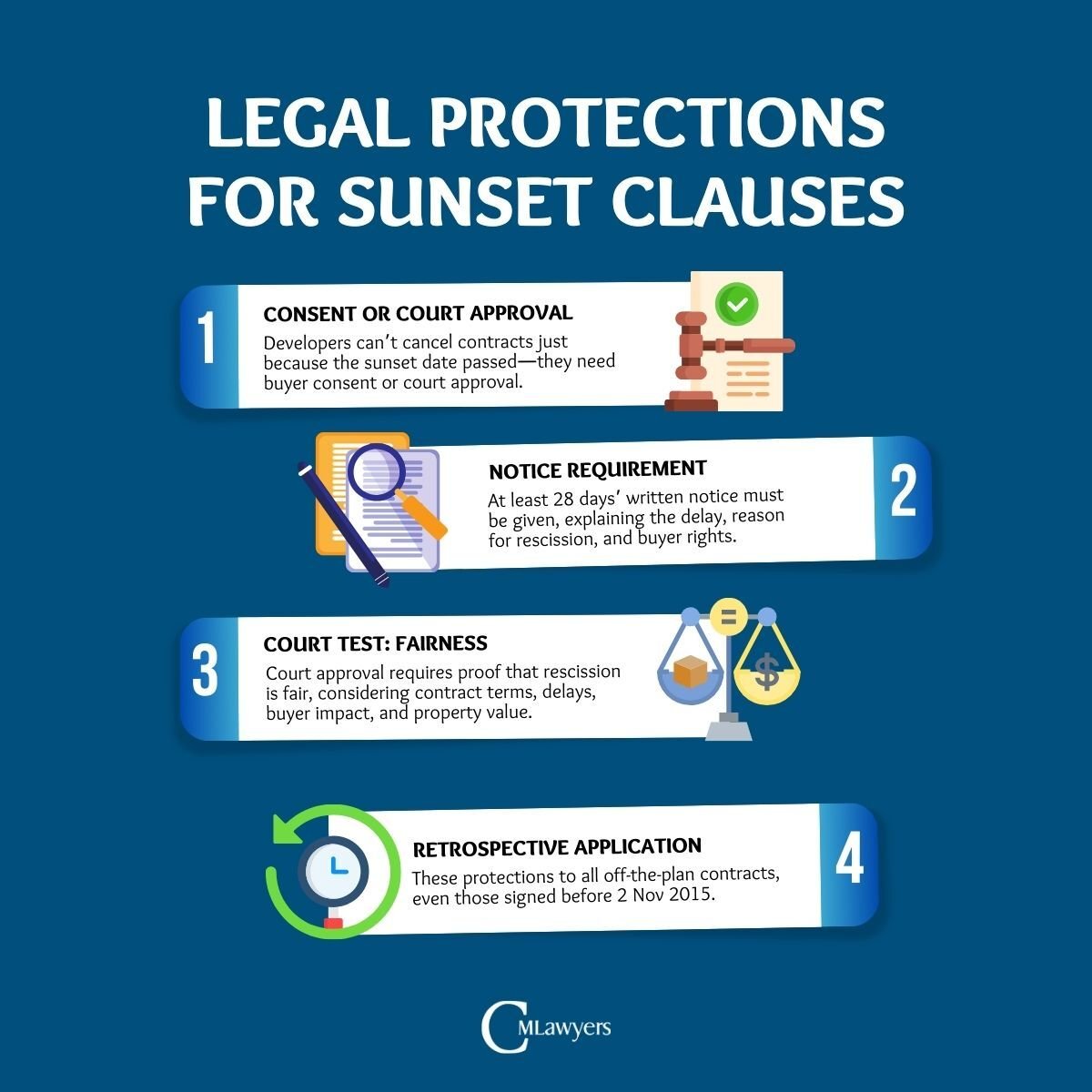

Key Legal Protections for Off-the-Plan Buyers in NSW

If you're browsing real estate listings near me or seeking homes to buy near me off the plan, it's vital to understand the legal protections in place. NSW laws have been strengthened to ensure developers are held accountable and that buyers aren’t unfairly pushed out of a contract. These reforms give buyers greater confidence when exploring property for sale under off-the-plan agreements.

Here’s a detailed breakdown of the protections now in place:

1. Written Consent or Supreme Court Approval Required

Under current NSW legislation, a developer can no longer rescind a contract simply because the sunset date has passed. They must first take one of the following steps:

-

Obtain the written consent of every purchaser involved in the development, or

-

Apply to the NSW Supreme Court and request an order allowing rescission.

This change is a major win for buyers searching for realty near me, as it ensures your contract can’t be cancelled on a whim. At CM Lawyers, we advise buyers on how to respond to such requests and protect their legal interests when developers attempt to invoke a sunset clause.

2. Notice Requirements

If a developer does seek to rescind an off-the-plan contract, they are legally required to give each purchaser at least 28 days’ written notice. This notice must clearly state:

-

The reason for the delay in completing the project

-

Why the developer wishes to rescind the contract

-

A clear explanation of the buyer’s rights, including the right to refuse consent

This transparency is crucial for buyers actively reviewing property for sale or engaging with local realty near me services. If you receive such a notice, CM Lawyers can help assess your situation and advise whether it’s in your best interest to consent or take further action.

3. Court Considerations

If a developer escalates the matter to court, they must prove that rescinding the contract is “just and equitable.” The court will consider multiple factors, including:

-

The terms of the contract

-

The reasons for the delay

-

Whether the developer acted in good faith

-

The financial impact on the buyer, such as lost investment opportunities

-

Whether the property has increased in value since the original contract

-

Any other relevant circumstances

These protections help level the playing field, especially for buyers who may have committed early while comparing homes to buy near me and expect developers to follow through on timelines and obligations.

4. Retrospective Application

One of the most significant aspects of these reforms is their retrospective application. The rules apply to all off-the-plan residential property contracts, even those signed before 2 November 2015. This means that if you’ve been locked into an older off-the-plan contract, you’re still protected under the current legislation.

Mandatory Disclosure for Off-the-Plan Contracts

In addition to sunset clause protections, NSW law now requires mandatory disclosures for off-the-plan contracts. Since 1 December 2019, developers must provide buyers with a Disclosure Statement and a set of key documents before the contract is signed. These include:

-

A draft plan of subdivision

-

Any proposed by-laws for strata properties

-

A schedule of finishes (so you know what fixtures and materials to expect)

-

Details of easements, covenants, or restrictions

-

Any other documents prescribed by law

If there are material or significant changes to these documents before settlement, buyers may be entitled to rescind the contract or seek compensation.

This is why having an experienced property lawyer is essential when considering real estate listings near me. At CM Lawyers, we ensure that your contract is reviewed thoroughly so you know exactly what you're signing up for—and what your rights are if things change.

Practical Tips for Off-the-Plan Buyers in NSW

Buying property off the plan can be a smart move, especially if you're searching online for homes to buy near me or comparing real estate listings near me. While off-the-plan properties often offer modern design and the potential for capital growth, they also come with legal complexities and long timelines. Here are practical tips to help you make an informed decision—and how CM Lawyers can support you throughout the process.

1. Get Expert Legal Advice

Off-the-plan contracts are highly detailed and often written in favour of the developer. Before signing anything, engage a qualified property lawyer or experienced conveyancer to review the contract thoroughly. At CM Lawyers, we pay close attention to key provisions—particularly sunset clauses, extension terms, and disclosure obligations—to ensure your interests are protected.

If you’ve found property for sale that interests you, don’t let legal risks go unnoticed. We’ll help you navigate the fine print and avoid costly surprises.

2. Assess the Sunset Date

Ask whether the sunset date outlined in the contract is realistic given the size and complexity of the development. Be cautious of clauses that allow the developer to extend the deadline for vague or broad reasons.

If you’re actively browsing real estate listings near me, be sure to compare sunset terms between developments. A too-flexible sunset clause might leave you waiting longer than expected—or even lead to a contract cancellation. CM Lawyers can help assess whether the timeline is fair and enforceable.

3. Research the Developer

A developer’s track record says a lot about the likelihood of successful project delivery. Before committing to an off-the-plan realty near me, look into:

-

Past projects and completion timelines

-

Any history of contract rescissions or disputes

-

Online reviews and media reports

Choosing a reputable developer reduces the risk of delays or misconduct. CM Lawyers can also assist with due diligence on developers and provide insight on any legal red flags in their past.

4. Monitor Construction Progress

After signing the contract, maintain regular contact with the developer or their agent. Request updates on construction milestones, expected completion dates, and any planning approvals. This helps you track progress and prepares you to act quickly if any issues arise.

If you’re searching for homes to buy near me off the plan, staying informed throughout the build process gives you peace of mind—and a better idea of when you can move in or rent out the property.

5. Know Your Rights

You cannot be forced to consent to a rescission under a sunset clause. If you receive a notice from the developer seeking to cancel the contract after the sunset date, do not agree immediately. Seek legal advice to understand your rights.

If you refuse to consent, and the developer applies to court for permission to rescind, you will have an opportunity to present your case. This is where CM Lawyers steps in—to represent your interests and protect your deposit, especially if you’re left unable to purchase a comparable property for sale in your budget.

6. Understand the Disclosure Statement

Before you sign an off-the-plan contract, the developer must provide a Disclosure Statement and key documents such as:

-

A draft plan of subdivision

-

Proposed by-laws for strata properties

-

Schedule of finishes and inclusions

-

Information about easements or restrictions

Significant changes to these documents before settlement could give you the right to rescind the contract or claim compensation. At CM Lawyers, we’ll review every disclosure detail and explain your options, so you’re never caught off guard.

Moving Forward with Confidence

Sunset clauses are meant to protect both parties, but they’ve also been misused in the past—especially in competitive markets. Thanks to NSW legal reforms, buyers now benefit from much stronger safeguards. If you're exploring real estate listings near me or thinking about homes to buy near me off the plan, understanding your rights is critical.

At CM Lawyers, we provide practical legal support to help you make confident property decisions. Whether you’re an investor or a first-time buyer looking at realty near me, we’ll ensure your contract is fair, your risks are managed, and your investment is protected from start to finish.

Ready to buy off the plan in NSW? Reach out to CM Lawyers today to ensure you're fully informed before signing any contract.

Comments